New Account Fraud: Still a Model of Success

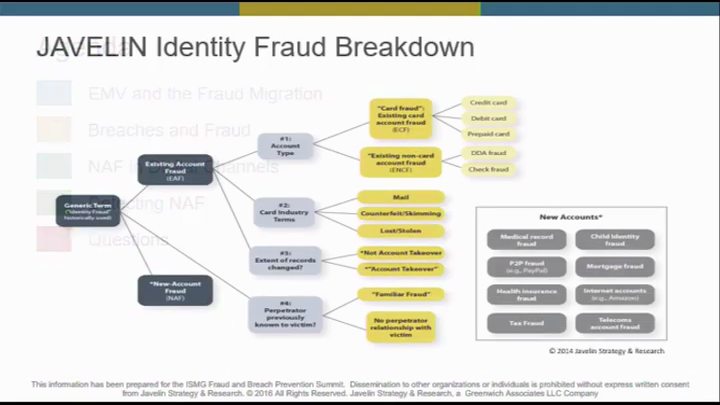

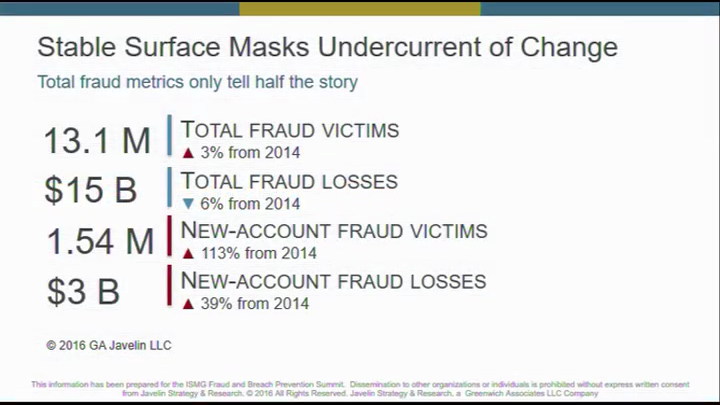

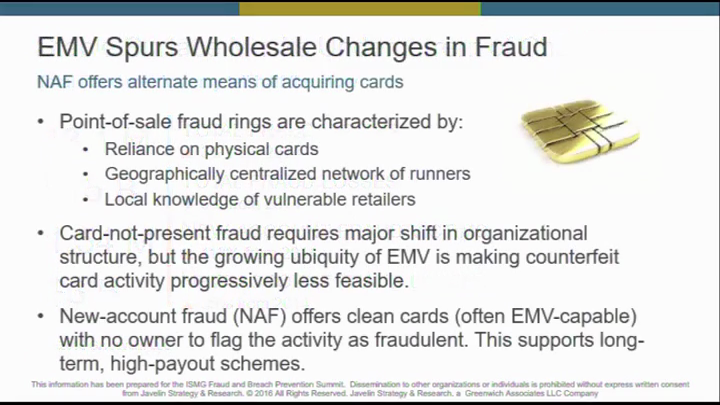

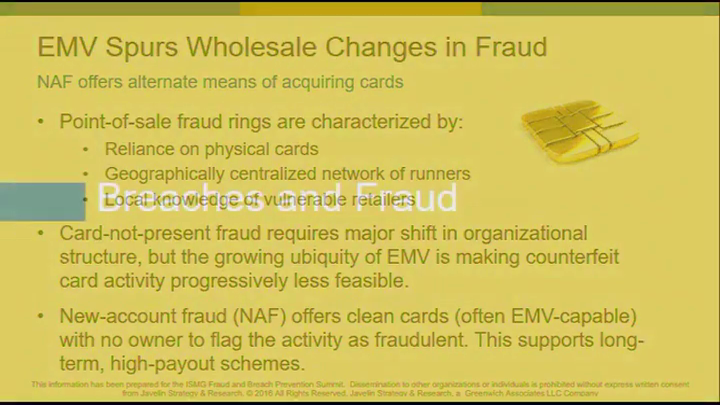

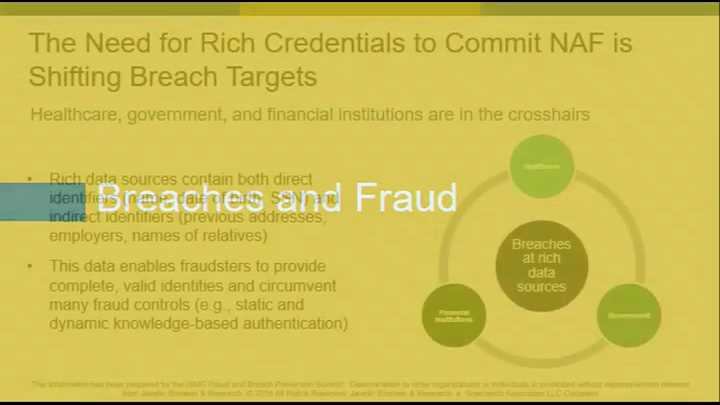

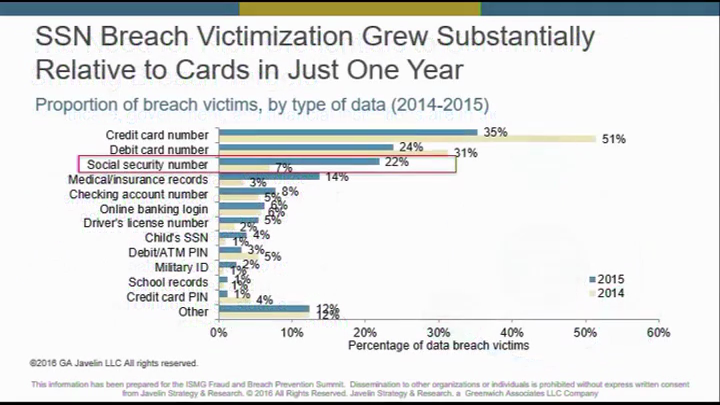

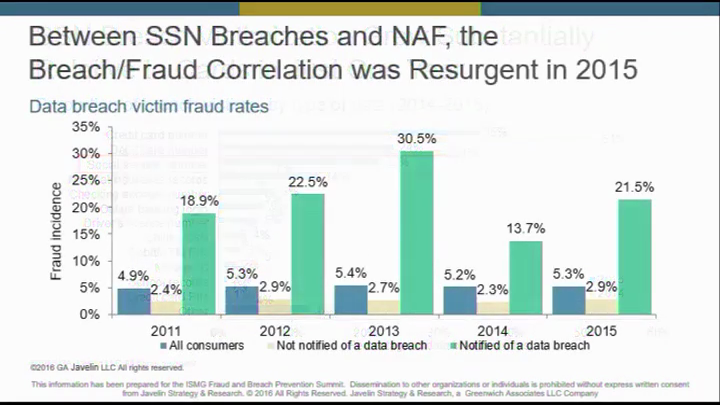

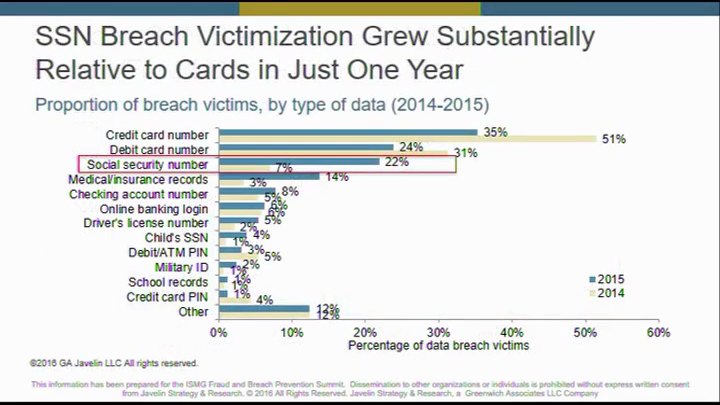

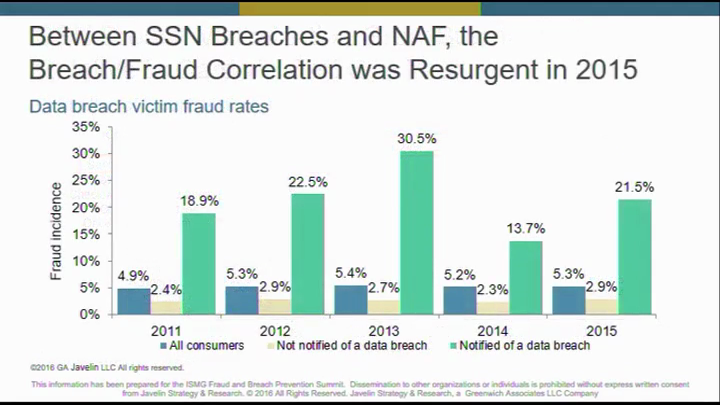

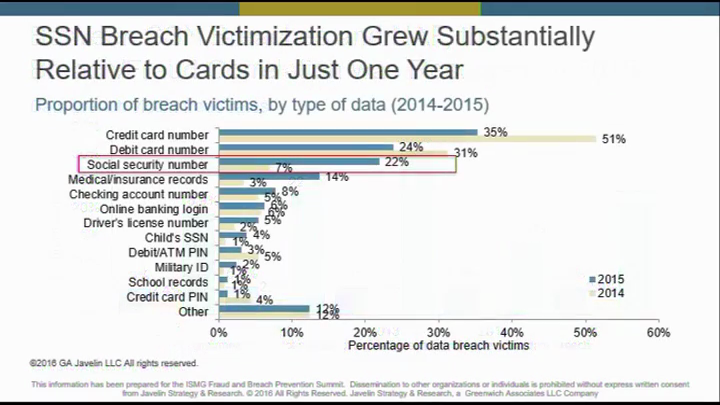

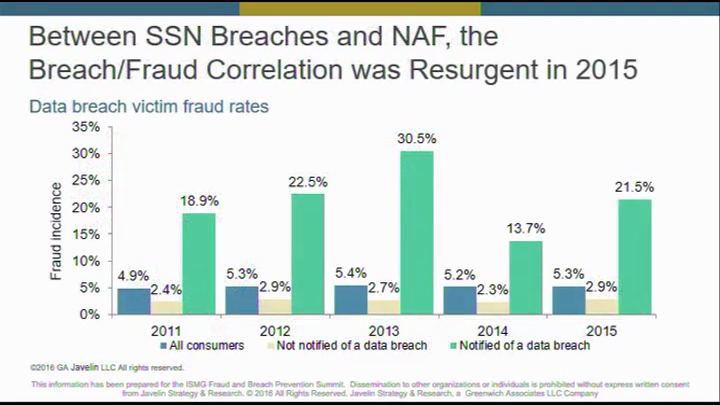

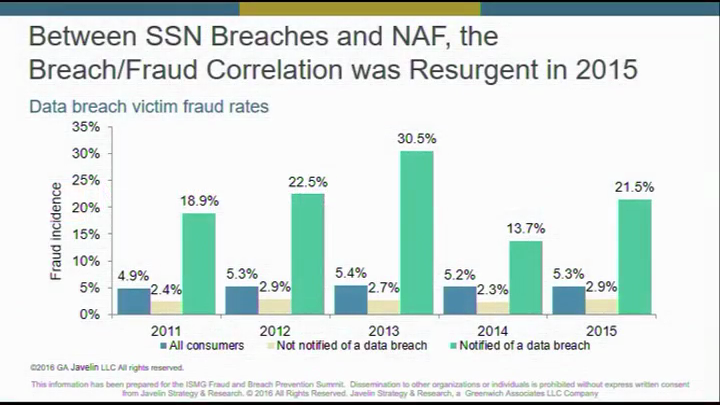

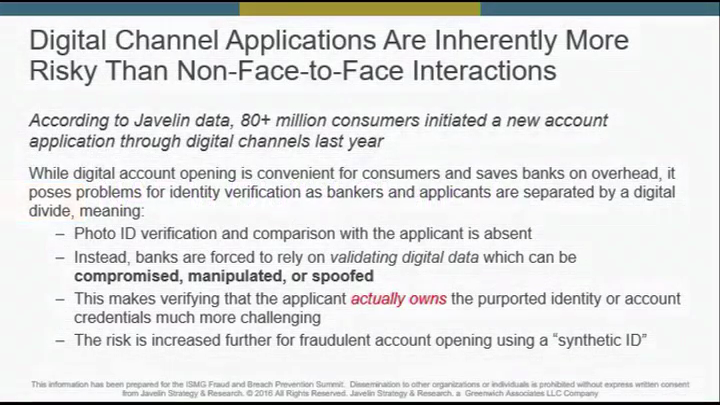

Account origination fraud remains one of the fastest growing threats today for organizations ranging from banks to government entities. According to statistics from the Javelin Strategy & Research firm, this type of fraud has risen from $2 billion total loss in 2014 to $3 billion in 2015, while the number of victims has more than doubled during that period - and the damage continues to grow. With account origination fraud so difficult to detect and with the stakes so high, this session will discuss:

See Also: 5 Emerging Email Attacks to Watch For in 2024

- The products and services at the greatest risk of new account fraud and the factors motivating these events;

- The customer experience and channel-specific challenges that confound efforts to ascertain the true identity of an applicant;

- Strategies and technologies to gain a more accurate and holistic picture of account applicants and respond in real time to risk;

- Ways to integrate solutions with your internal and consumer-facing systems in order to more quickly assess risk and to identify inconsistencies.

Additional Summit Insight:

Hear from more industry influencers, earn CPE credits, and network with leaders of technology at our global events. Learn more at our Fraud & Breach Prevention Events site.